Fighting for the Spotted Owl

We are going to court to protect the last wild-born Spotted Owl.

Learn more

Photographer Tilly Nelson, set design Kendra Martyn & Kira Evenson

#GenClimateAction

We're taking the Ford government to court for rolling back its climate target.

Meet the clients

Photo by fotdmike

What’s new

Ecojustice helps people like you take governments and polluters to court and call for better laws to protect the people and places we love. Here’s the latest on what our team has been working on.

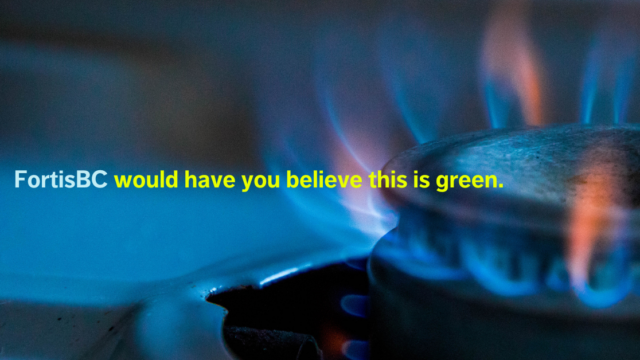

Fight climate chaos

Tell your bank to stop funding fossil fuels

Canada’s banks and insurance firms are among the world's top backers of coal, oil, and gas projects.

Stop them using your money to fund the climate crisis.

Send an email now